INDEXED UNIVERSAL LIFE

Bring New Life To Your Retirement

Savings Tax And Risk Free!

Bring New Life To

Your Retirement

Savings Tax And

Risk Free!

Tax-Free Money

Interest & principal tax-free

Living Benefits

Pays for major illnesses

Downside Protection

No volatility or market risk

Uncapped Market Growth

No limit on interest growth

What Is An Indexed Universal Life (IUL)

An IUL is simply another supplemental retirement account where you can earn interest and grow your contributions tax-free. Unlike a term policy, an IUL lasts for your entire lifetime.

It has an invaluable tax-free cash value component that’s not tied to market risk. Unlike a 401K, you can access your money prior to age 59.5 without an early IRS tax penalty.

In fact, IULs are quickly gaining popular momentum due to their flexibility, liquidity, and safety. In Q4 2021, they accounted for a whopping $718 million in sales just in one quarter. This makes them a perfect hybrid between your savings account and 401k.

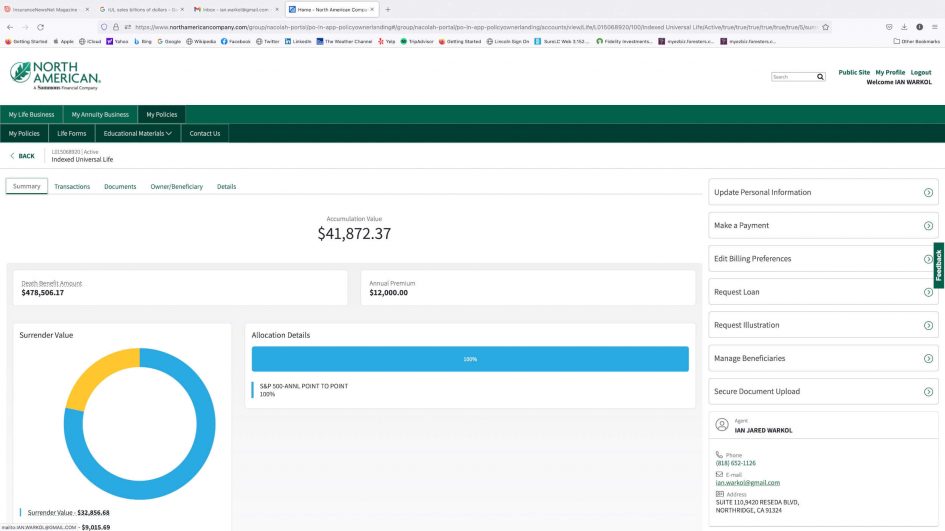

With this in mind, Ian Warkol is actually putting in $12K a year into his IUL complementing both his Roth IRA and SEP IRA accounts. Please see below for proof of his annual contribution:

One of the best ways to understand how an IUL can benefit you is watching the following video. The presenter does an excellent job highlighting all the moving parts and details in an easy, digestible format.

This video alone has helped many of Ian’s existing clients make an informed decision to better diversify risk and lower taxable income.

A Snapshot Of How IULs Are The "New 401Ks"

Additionally, more and more families are considering IULs for their children since there are no income or job requirements for eligibility. A child's parents can simply pay into his/her IUL. When they reach a certain age, say 26, the now developed young adult becomes the payor and full owner of the policy.

By setting up an IUL at an adolescent age, the child has massive head start and advantage toward the path of early retirement. The longer and earlier you keep the IUL funded, due to compounded interest mechanics, the faster you can become financially free!

Want To Learn How Your Children Can Also Benefit From An IUL?

The Three Legged Stool Is A Must For Any Retirement! Failing To Plan Is Planning To Fail!

A 401K is one of the main legs everyone should have since most employers match your contribution. This is essentially free tax-deferred money on the table you can take advantage of.

Secondly, to retire comfortably, you need to consider a tax free plan like an IUL. Taxes are only going up in the future especially since our economic deficit is more than $30 trillion.

So, for example, that $1 million 401K you thought you were going to have for retirement will be at least 30% less due to taxes.

However, with an IUL policy, you pay taxes on the seed (initial premiums), but not the harvest (the loans on the account that you'll access later).

Thirdly, there are no guarantees in life. At one point, if you have a chronic health condition, or need nursing care services, without a plan B, you might be out of luck. Studies have shown 70% of 65 year olds or older will need some form of long term care services.

All that hard earned money saved could be used up for these expensive medical services further draining your retirement portfolio.

To learn more about Living Benefits and how it can protect your financial assets, click here.

IUL Benefits: Main Takeaways

Cash Value That Grows Tax Free

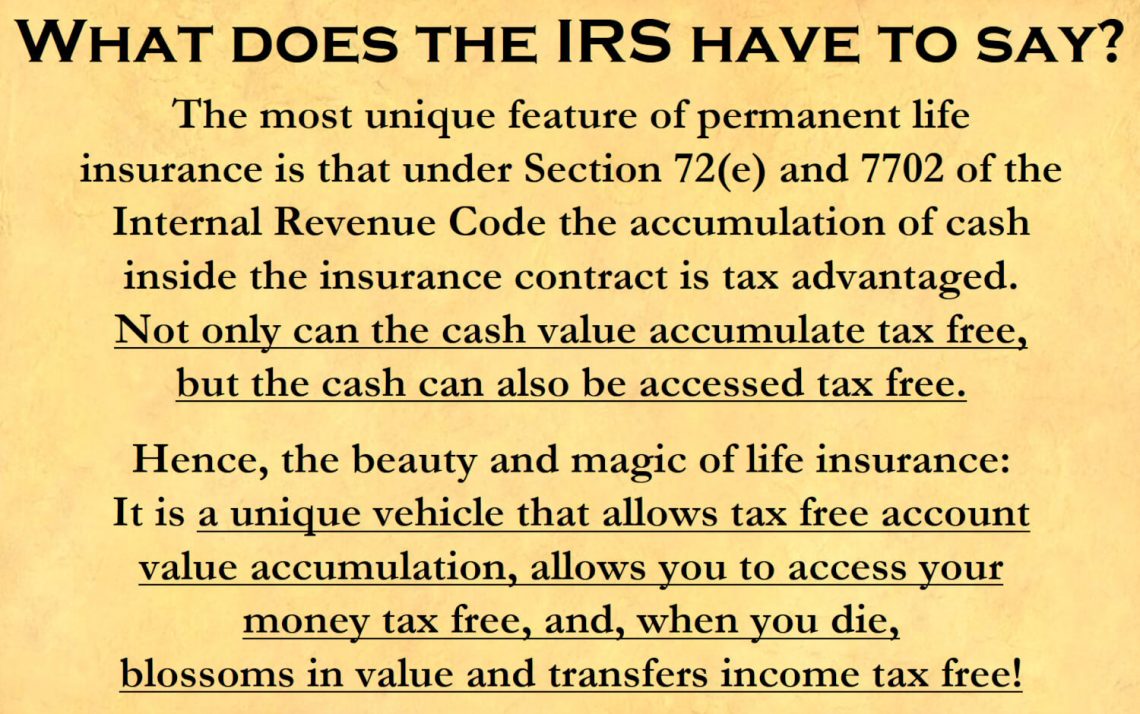

According to IRS Section 72(e) and 7702, your money grows on a tax-free basis including any withdrawals if made in the form of loan.

Living Benefits

Pays for medical bills resulting in any or all of the following illnesses (click each tab below for the definition).

Terminal Illness

- If an eligible insured is diagnosed with an illness or condition that is expected to result in death within 24 months or less. (12 months in FL and NY)

- Available on all rate classes

Chronic Illness

- If an eligible insured is unable to perform 2 of 6 activities of daily living (ADL) for a period of at least 90 days or requires constant supervision to protect from threats to health or safety due to severe cognitive impairment.

- The ADLs include bathing, continence, dressing, eating, toileting, and transferring.

Critical Illness

Some examples include the following (subject to carrier availability):

- Heart Attack

- Stroke

- Invasive Cancer

- End-Stage Renal Failure

- Major Organ Transplant

- ALS (Lou Gehrig's disease)

- Blindness

- Sudden Cardiac Arrest

More Liquidity

Unlike a traditional retirement account, you can access your money prior to 59 ½ without an IRS penalty.

The money can be used for college tuition, vacation, down payment on a new home, or any other expense.

Zero Market Risk

A major competitive advantage of an IUL is security. It’s one of the safest retirement vehicles because of the added no-market risk value.

This means you don’t lose any money if the stock market performs negatively and even at the point of an economic recession.

Social Security Is Fully Maximized

Nearly 6 in 10 people under 55 are willing to work more to save for social security. This is huge considering social security could be substantially reduced at retirement due to hyper-inflation.

The good news is withdrawing money from an IUL as a loan, by IRS definition, isn't considered income.

This means your social security benefits will remain unaffected and fully maximized.

Have Questions? Want To Know How To Properly Structure An IUL To Maximize Your Retirement?

Just book a free conversational call with Ian and find out whether an IUL is a good fit for you. He’ll be happy to provide more education and answer your questions.