The Greatest Priority In Life Is Your Health

Living Benefits

A Life Insurance Policy Without Living Benefits Is Like Flying Without A Parachute

See How Richard Survived Stage 4 Cancer Below

Out of the four groups of professions I speak to on a daily basis...

Healthcare

Homeowners

Teachers

Federal Employees

For one, the majority of these professions above will lose half of their coverage when they turn 65-70 years old.

For another, some group plans, are substantially expensive after the age 50 with the rates going up every 5 years.

What’s even worse is none of these policies come with living benefits, which is the cornerstone to every life insurance policy. Without it, you’re like walking through life without an insurance policy on your health.

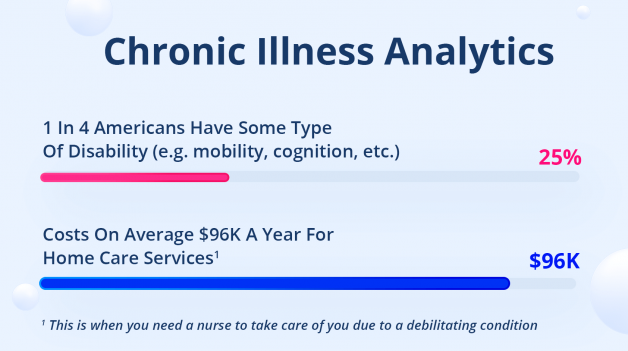

Imagine if you dont have a plan B in case you get sick or physically impaired. The fear of losing your home, life savings, and/or retirement account to pay for these expensive medical bills becomes even more haunting:

- If you’re the primary bread provider without spousal income

- If your income is strictly limited

- If you recently refinanced and can’t keep up with the higher monthly payment

In fact, to give you perspective on how expensive these home health/nursing care bills can be without living benefits, please refer to the chart below:

Source: Courtesy Of Genworth

For a more realistic home/long term care expense in your city and state, click here to get a free estimate

Nowadays, a lot of pastors, teachers, nurses, and federal employees don’t have an all-encompassing plan that provides full benefits to safeguard your financial assets in the event of sickness, disability, and terminal illness.

This is where Living Benefits comes into play giving you and your family the financial peace of mind and comfort you deserve!

This product provides flexible access to income from your policy for qualifying expenses. This way, your day-to-day bills and bank accounts are kept intact safeguarding them from financial hardships.

The following section below, sheds more light and why this additional protection is the “swiss army knife” everyone should consider.

How Living Benefits Can Help Preserve And Protect Your Home And Other Assets If You Get Sick

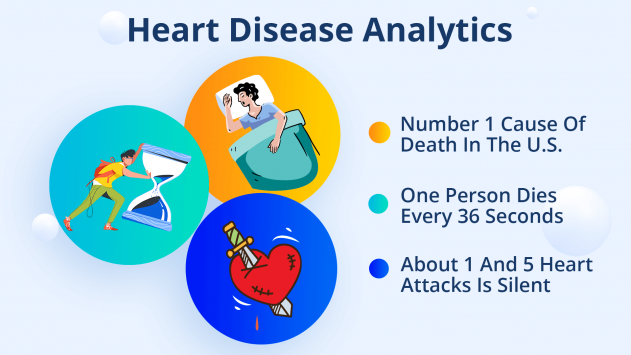

As you may know by now, chronic and critical conditions in the U.S. cannot go unnoticed. Living without any form of coverage against these unpredictable, paralyzing events is a recipe for disaster!

The best form of protection is with a well-grounded safety net – Living Benefits Protection. Together, with a fixed life insurance plan, they’re the best of both worlds securing the unexpected and your loved ones future.

Here is one of the ways how living benefits saved a 30 year old mom, Jessica, against a financial/medical “storm” - breast cancer:

The Truth Of The Top Three Major Diseases Most People Underlook

Chronic Illness References

- Based On The Centers Disease Control And Prevention

- Based On The Consumer Affairs ($96K Cost)

- Home Health Care Services Can Cost More Than $96K Per Year Depending On The State. Click For An Estimate Of Your State

The Most Comprehensive Living Benefits Company In The Industry

Included Living Benefits | Qualifying Conditions (subject to final underwriting approval) |

|---|---|

Terminal Illness Rider | Generally, if an eligible insured is diagnosed with a terminal illness that will result in death within 24 months or less. (12 months in some states) of certification of the illness by a physician. |

Chronic Illness Rider | A doctor has certified, within the past 12 months, that you are unable to perform 2 of 6 activities of daily living (ADL) for a period of at least 90 consecutive days without assistance. or that you are generally cognitively impaired.

Activities Of Daily Living: bathing, continence, dressing, eating, toileting, transferring. |

Critical Illness Rider | Includes:

|

Critical Injury | Includes:

|

National Life Group Brochures

If you want to read more about National Life's Group history and other brochures, click here.

Have Questions? Want To Find Out How You Can Take Advantage Of Living Benefits Today?

Just book a free conversational call with Ian and he will be more than happy to give you more information. He'll find the most appropriate plan for your occupation and family needs being contracted in more than 30 carriers and states.