The New Mortgage Protection

Living Benefits

A Necessity For Every Homeowner's Well-Being And Financial Security

When you buy a home or refinance you’re making one of the biggest decisions in your life. If you’re like most people, protecting your loved ones is important to you. This becomes even more relevant when you have children. Eventually, this greatest financial asset will be transferred to them, so you want to ensure it’s covered at all angles without the risk of a default.

The fear of losing your home due to a foreclosure even becomes more glaring and concrete:

- If you’re the primary bread provider and your spouse doesn’t have any income to alleviate the mortgage expense

- If you become disabled or have a serious medical illness making it harder to pay for the mortgage

- If you recently refinanced and can’t keep up with the higher monthly payment

Nowadays, a lot of homeowners don’t have an all encompassing plan that provides full benefits to safeguard your home in the event of sickness, disability, and terminal illness.

This is where the new Mortgage Protection Living Benefits comes into play giving your family the peace of mind and comfort they deserve!

Mortgage Protection Living Benefits can give your family access to income from your policy instead of leaving a huge dent in your savings to pay for qualifying expenses. This way, your mortgage bill is kept intact preventing you from losing your home, especially during financial hardships.

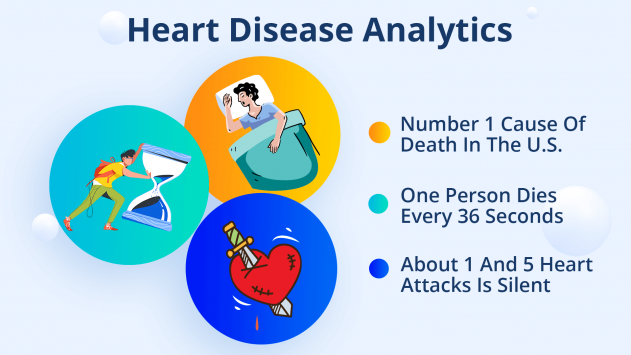

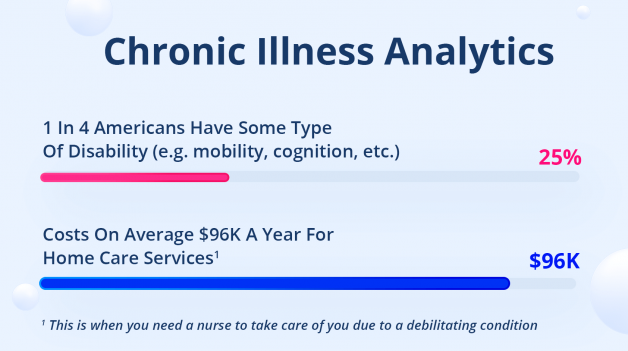

Some common financial constraints that cause more foreclosures than death itself are actually due to medical diseases such as cancer, heart attack, stroke, etc. These kinds of health misfortunes are one of the leading reasons why families cannot satisfy their mortgage payments.

In fact, let’s take a deeper nosedive on the magnitude of these crippling illnesses!

The Truth Of The Top Three Major Diseases Most People Underlook

Chronic Illness References

- Based On The Centers Disease Control And Prevention

- Based On The Consumer Affairs ($96K Cost)

- Home Health Care Services Can Cost More Than $96K Per Year Depending On The State. Click For An Estimate Of Your State

How Living Benefits Can Help Preserve And Protect Your Home And Other Assets If You Get Sick

As you may know by now, chronic and critical conditions in the U.S. cannot go unnoticed. As a homeowner and family-person, living without any form of coverage against these unpredictable, paralyzing events is a recipe for disaster!

The best form of protection is with a well-grounded safety net - Living Benefits Mortgage Protection. Together, in unison, they’re the powerhouse, the best of both worlds in planning for the unexpected AND securing your loved ones future.

Here is one of the ways Living Benefits can be your fortress against a financial/medical “storm”

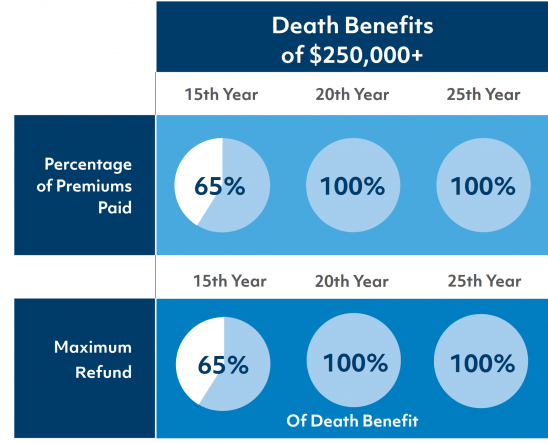

One of our most beloved and top carriers who specializes in providing a full living benefits and life insurance package is American National. They’re also one of the few companies until this day offering a bonus benefit: Money Back, Refund Guarantee.

Below is table from American National summarizing the key features and definitions of all four benefits:

The Heart-And-Mind Of Living And Money Back Benefits

Living Benefits | Qualifying Conditions (subject to final underwriting approval) |

|---|---|

Terminal Illness Rider |

|

Chronic Illness Rider |

|

Critical Illness Rider | A Critical Illness may include the following (not available in New York):

|

Bonus Benefit | Description |

|---|---|

Money Back/Refund Rider |

|

American National Brochures

Have Questions? Want To Find Out How You Can Secure Your Mortgage With Living Benefits?

Just book a free conversational call with Ian and he will be more than happy to coach you on anything you need help on. He’ll pair you with the right options, coverage, and carrier as he specializes across more than 30 carriers and states.